If he reports only the 60 he gets then the 40 is not a deduction as it was not part of income. The artist may have other business expenses available to deduct such as a home office if the artist has a drawing table used exclusively for designs.

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

Itll turn out to be Schedule C profit 09235 0153.

. You cannot claim a deduction for the cost of maintaining general fitness or body shape. Barbara calculates her employment expenses by adding her travelling expenses artists employment expenses and musical instrument expenses 1550 650 350 2550. The key lies in being able to accurately produce receipts as proof of your spending solely for your business.

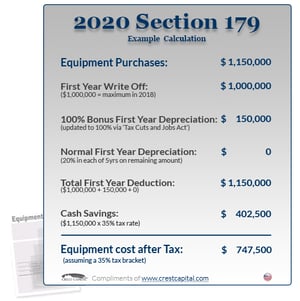

Tax Write Offs For Tattoo Artists. Youre able to claim this deduction if youre in a recognized. For several of the past years the deduction was at 25000 with investment limit at 200000 and was raised to a deduction of 500000 with an investment limit of 25MM late in the year by Congress.

This typically can be. Qualifying Tax Deductions. An artist may also deduct the cost of museum and gallery memberships traveling to tattoo shows whether you work there or not and even trade magazine subscriptions as business-related expenses.

Our qualified team of accountants can guide you through the different expenses that you can include on your tax return to save on payments. This is a basic list of typical expenses incurred by artists. Most Tattoo Artists are known for their individual creativity out-of-the-box thinking and non-conformist mentality all in a very positive wayTattoo Artists as independent contractors receive a Form 1099 for services and must report income.

This calculates your Social Security tax and Medicare tax on your profit. You pay this with your income taxes but you also get a deduction of half this amount before you calculate the income tax. I dont will need a hoop when I have these nails she says.

Use this list to help organize your art tax preparation. First theres a special deduction for expenses paid in 2018 to earn employment income from an artistic activity. For those that have an art studio in your home that is used exclusively for your art business or making art you can deduct a portion of your monthly overall expenses for that space.

Artists benefit from two interesting exceptions to this rule. The purchase of ink. An artist may exclude the first 500 of total scholarships fellowships bursaries and prizes that were included while calculating their taxable income for the tax year.

Tattoo artist tax deductions Eunkyung likens this style to jewellery. With works of art commanding record prices todays art market has become a boon for sellers who stand to realize significant returns on their investments and a detriment to museums and other charitable organizations which have grown increasingly dependent on. So if you owed 12000 in federal taxes for the 2011 tax year you would be required to pay 12000 during 2012 to meet your required estimated tax payments.

If you have a studio outside of your home the total rent and utilities are fully deductible business expenses. The optimal Option will be the designs in. Your net income is your gross income minus expenses.

Im a tattoo artist working for a shop. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Buffalo New York. If you received a 1099 for money that you earned that 1099 came from someone else who reported your income to the IRS.

This is 0 lower -39 than the average tattoo artist salary in the United States. Whats left after expenses is your net income. The last thing that happens is that you get your taxable income and your taxable income is generally pretty akin to what we call your net income.

While many of your clients may come from word-of-mouth marketing tools are an often overlooked deductible expense. The tax rules surrounding the tax deduction of art are complex and confusing¹. Here are the deduction limits for recent years.

Books magazines reference material. Estimated taxes owed are based on the previous years tax bill. You can claim a deduction for fitness expenses if you are required to maintain a very high level of fitness and physical activity is an essential element in your work for example as a trapeze artist.

In addition they earn an average bonus of 442. Tattoo Artist Tax Deductions. I pay the shop 50 of what I make.

My husband is a tattoo artist and makes 60 off each tattoo and the shop takes 40 of that can we deduct the 40. In 2018 Congress doubled the deduction limit by raising it 1000000. Completing your tax return Enter the amount you can deduct on the Artists employment expenses line 9973 of Form T777 Statement of Employment Expenses.

Home office deductions are calculated as a percentage of the square footage in the house the percentage being applied to monthly rent or mortgage payments to determine the dollar amount of the deduction. Part-time students can only partially claim this exemption which can be estimated by using CRAs Scholarship Exemption. The following are expenses that a tattoo artist may claim.

An entry level tattoo artist 1-3 years of experience earns an average salary of 25999. Cultural events museum entrance fees. The varied reasons to donate art include a personal affinity for a museum the desire to create a legacy and the tax consideration that may come with the donation.

Tax Implications of Selling Donating or Lending Art. June 1 2019 808 AM. The cost of needles.

Do I give the shop a 1099 or do they give me one. Tax write offs for tattoo artists From time to time youd like an first and simultaneously an easy nail design. So some tattoo parlor Im guessing hired you paid you and then basically sent two 1099s one to the IRS to report how much they paid you and another to you telling you how much they paid you.

These are our tax deductions or just our business expenses. You may have others. Recreate the glance with a glitter polish and a toothpick or very small brush dabbing very carefully to produce your outlines.

If he reports the 100 of the income then the shop charge of 40 is a deduction.

How Much To Tip A Tattoo Artist Trending Tattoo

Is Your Tattoo Shop Ready For Tax Day Daysmart Body Art Inkbook Tattoo Software

How To File Taxes As A Tattoo Artist How To Discuss

Is Your Tattoo Shop Ready For Tax Day Daysmart Body Art Inkbook Tattoo Software

3 Types Of Tax Deductions And How To Track Them

3 Types Of Tax Deductions And How To Track Them

Deduct Your Tattoo Removal Laser All About Section 179

Is Your Tattoo Shop Ready For Tax Day Daysmart Body Art Inkbook Tattoo Software

0 comments

Post a Comment